Reality Check! There is no such thing as emotionless trading AND in many respects, it may be considered that it is a good thing too.

After all, correctly targeted emotions will allow you to:

- Have an exciting, compelling trading purpose that drives you to do the hard yards with your learning (we know some people fail to complete a course or put learning into action).

- Be motivated to do your due diligence and make sure you have ticked all the boxes before you press any trading buttons and take action with entry and exit.

- Celebrate when you do the right thing (Remember: this includes keeping that loss small when you should) and

- Feel PAIN when you donate to the market needlessly through poor or inappropriate execution (providing of course you take the lesson AND take more appropriate action next time while placing the blame where it should be).

So YES, let’s get aroused!

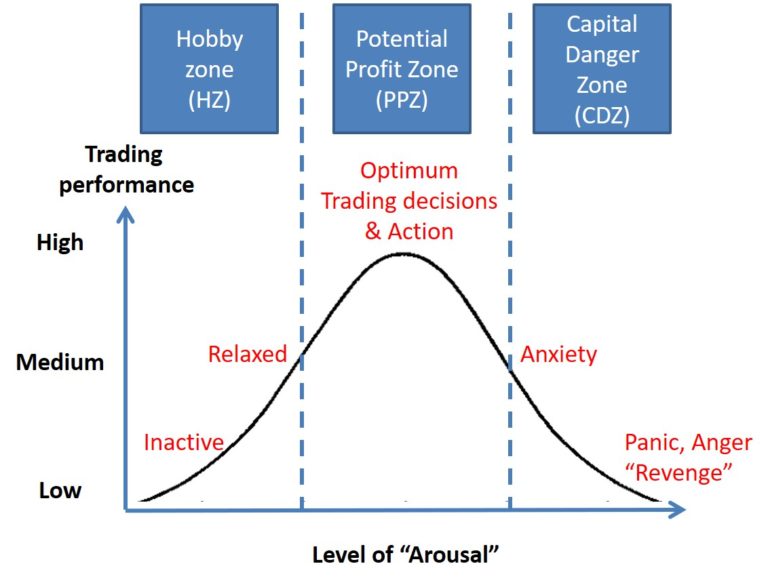

If we hit the right level of trading arousal EVERY TIME and it’s driven by channelled, enabling emotion, this may create a higher probability that when we get to the ‘press-the-button’ stage we do it with a calm confidence and will more likely have a better trading outcome or as we have called it here the “Potential Profit Zone” (Remember: it is equally a win to make sure that any loss is within your tolerable risk level meaning your long term results are more likely to be positive).

Either extreme of arousal is not likely to produce the results we desire, either through not taking our trading seriously enough (the “Hobby Zone”) to do the things we must (due diligence; careful consideration of strategy selection; making sure it REALLY fits your plan), or though making decisions that are most certainly extreme NOT from the right emotional place (the “Capital Danger Zone”).

Take a look at the diagram below that aims to illustrate this:

This middle zone is where we need to be, so sufficiently stimulated to do the right things consistently (even though these may appear to be a chore and some until they become habits).

If you don’t apply this level of emotion to your trading and trade in the “Hobby Zone”, it is less likely you will be sufficiently “aroused” to spot an opportunity and then trade it without lengthy procrastination. Or equally if not more important to exit a trade in a timely, confident manner either to take profit or minimise any loss from a single trade.

You need to operate with the decisive action of a “trading Ninja” with the appropriate peak state of arousal or in other words in the “Potential Profit Zone”. This may be more likely to give yourself the best chance of optimising trading results.

Neither do we want to be in a state of being over-stimulated to the point where you become a trading ‘fruit-loop’ (not the technical term) and perilously exposed to some of the more “dangerous” emotions. To make trading decisions when anxious, angry (that revenge trading thing!), or trading out of fear rarely produces good results and can mutilate a portfolio value quicker than saying “not having a stop loss in place is completely bonkers”.

So, it’s a balance of the two extremes – surely, it is logical that some emotion is good as it motivates you to do the right thing and follow through on your learning, direct trading and measuring, and there are some emotional states that are hugely damaging.

So, your mission after reading this post (as it’s always best to take some action) is to make a ten-second assessment of your ‘state of arousal’ before you press an entry or exit button for every trade this coming week (YES! You can start now). Make the judgement as to which of these described zones you may be trading from.

One final word: if you want evidence of whether the right state of arousal is likely to produce peak performance, then look at other situations where that might also be the case….just a different context, that’s all.

GET AROUSED!

Mike Smith